Why Cybersecurity is Important for a Financial Institution?

Table of Contents

Introduction

In the modern digital era, financial institutions are at the forefront of technological innovation. While these advancements offer tremendous benefits, they also bring significant risks. Cybersecurity has become a critical concern for banks, credit unions, investment firms, and other financial entities. The importance of robust cybersecurity measures for financial institutions cannot be overstated, given the sensitive nature of the data they handle and the potential repercussions of cyber attacks. This article explores why cybersecurity is crucial for financial institutions, the specific threats they face, and the essential security measures they should implement.

The Significance of Cybersecurity in the Financial Sector

Financial institutions are custodians of vast amounts of sensitive information, including personal data, financial records, and transaction details. This makes them prime targets for cybercriminals who seek to exploit vulnerabilities for financial gain, data theft, or to disrupt operations. Here are key reasons why cybersecurity is paramount for financial institutions:

- Protecting Sensitive Data: Financial institutions manage vast amounts of sensitive information, including personal and financial data. Unauthorized access to this data can lead to identity theft, financial fraud, and significant financial losses for both the institutions and their customers.

- Maintaining Customer Trust: Trust is the cornerstone of any financial institution. Clients need to feel confident that their personal and financial information is secure. A single data breach can severely damage an institution’s reputation, leading to a loss of trust and clientele.

C9Lab’s QSafe provides comprehensive brand protection, helping institutions safeguard their reputation by detecting and mitigating fraudulent activities.

- Complying with Regulatory Requirements: Financial institutions are subject to stringent regulatory requirements designed to protect customer data and ensure the integrity of financial systems. Non-compliance can result in hefty fines and legal penalties, as well as reputational damage.

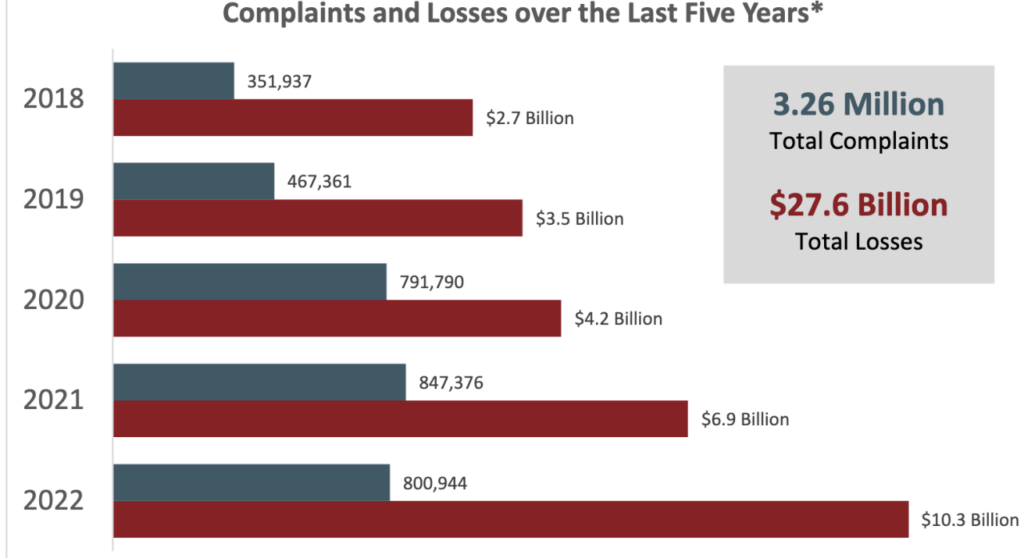

- Preventing Financial Losses: Cyber attacks can lead to substantial financial losses, not only through direct theft but also through operational disruptions, legal fees, and the costs associated with repairing damaged systems and reputations.

Utilizing C9Lab’s C9Eye, institutions can conduct regular vulnerability assessments to prevent financial losses.

- Ensuring Operational Continuity: Financial institutions rely on complex IT systems to operate efficiently. Cyber attacks can disrupt these systems, leading to downtime, loss of productivity, and potential financial chaos.

- Countering Evolving Threats: Cyber threats are continually evolving, becoming more sophisticated and harder to detect. Financial institutions need to stay ahead of these threats to protect their assets and ensure the ongoing security of their operations.

Key Cyber Threats Facing Financial Institutions

Financial institutions face a wide range of cyber threats, each with the potential to cause significant damage. Some of the most prevalent threats include:

1. Phishing Attacks

Phishing attacks are one of the most common cyber threats faced by financial institutions. Cybercriminals use deceptive emails, messages, or websites to trick individuals into providing sensitive information, such as login credentials or financial details. These attacks can lead to unauthorized access to accounts and data breaches. C9Lab’s C9Phish offers AI-based awareness training to help employees recognize and avoid phishing attempts.

2. Ransomware Attacks

Ransomware is a type of malware that encrypts an institution’s data, rendering it inaccessible until a ransom is paid. This sector is the attractive targets for ransomware attacks due to the potential for significant financial gain. These attacks can cause operational disruptions and financial losses.

3. Data Breaches

Data breaches involve unauthorized access to sensitive information. For financial institutions, this can include customer data, financial records, and proprietary information. Data breaches can result in financial losses, legal consequences, and reputational damage.

4. DDoS Attacks

Distributed Denial of Service (DDoS) attacks overwhelm an institution’s network with a flood of traffic, causing system slowdowns or outages. These attacks can disrupt services, prevent access to online banking, and damage customer trust.

5. Insider Threats

Insider threats involve employees or other insiders who misuse their access to sensitive information for malicious purposes. These threats can be difficult to detect and can result in significant financial and reputational damage. C9Lab’s comprehensive monitoring solutions help detect and prevent insider threats by providing real-time alerts and analysis.

6. Advanced Persistent Threats (APTs)

APTs are sophisticated, long-term cyber attacks that target specific organizations to steal information or disrupt operations. Financial institutions are often targets of APTs due to the valuable data they hold and their critical role in the economy.

Essential Cybersecurity Measures for Financial Institutions

To protect against these threats, financial institutions must implement comprehensive cybersecurity measures. Here are some key steps to enhance cybersecurity:

1. Implement Robust Security Protocols

Financial institutions should establish and enforce robust security protocols to protect sensitive data and systems. This includes using strong encryption for data storage and transmission, implementing multi-factor authentication, and regularly updating software and systems to patch vulnerabilities.

2. Conduct Regular Security Assessments

Regular security assessments are crucial for identifying vulnerabilities and addressing potential threats. Financial institutions should conduct internal and external audits, vulnerability assessments, and penetration testing to evaluate their security posture and make necessary improvements.

3. Educate Employees on Cybersecurity Best Practices

Employees are often the first line of defense against cyber threats. Financial institutions should provide regular cybersecurity training to educate employees on best practices, such as recognizing phishing attempts, securing passwords, and following data protection protocols.

4. Deploy Advanced Threat Detection and Response Tools

Advanced threat detection and response tools, such as intrusion detection systems (IDS) and security information and event management (SIEM) systems, can help financial institutions detect and respond to cyber threats in real time. These tools provide valuable insights into network activity and potential security incidents.

5. Establish a Comprehensive Incident Response Plan

Having a comprehensive incident response plan is essential for quickly and effectively addressing security incidents. Financial institutions should establish protocols for detecting, reporting, and responding to cyber incidents, as well as procedures for recovering from data breaches or other security events. C9Lab provides support for developing and implementing effective incident response plans.

6. Collaborate with Industry Peers and Authorities

Collaboration with industry peers and regulatory authorities can help financial institutions stay informed about emerging threats and best practices. Participating in information-sharing initiatives and industry groups can provide valuable insights and support for enhancing cybersecurity.

7. Invest in Cybersecurity Technologies

Financial institutions should invest in cutting-edge cybersecurity technologies, such as artificial intelligence (AI) and machine learning, to enhance their security capabilities. These technologies can help detect and mitigate threats more effectively, ensuring a higher level of protection. C9Lab leverages AI and machine learning in its security solutions to provide state-of-the-art protection for financial institutions.

Conclusion

Cybersecurity is critical for financial institutions to protect sensitive data, maintain customer trust, and ensure operational continuity. By understanding the cyber threat landscape and implementing comprehensive security measures, financial institutions can safeguard their assets and build a resilient defense against cyber threats. The evolving nature of cyber threats necessitates a proactive approach to cybersecurity, making it an ongoing priority for financial institutions of all sizes. C9Lab is committed to providing financial institutions with the tools and expertise needed to secure their digital assets and protect against emerging threats.

Keep your business safe and informed with the latest cybersecurity news, insights, and expert tips.

📬 Subscribe to Our Newsletter: Cyber Briefs